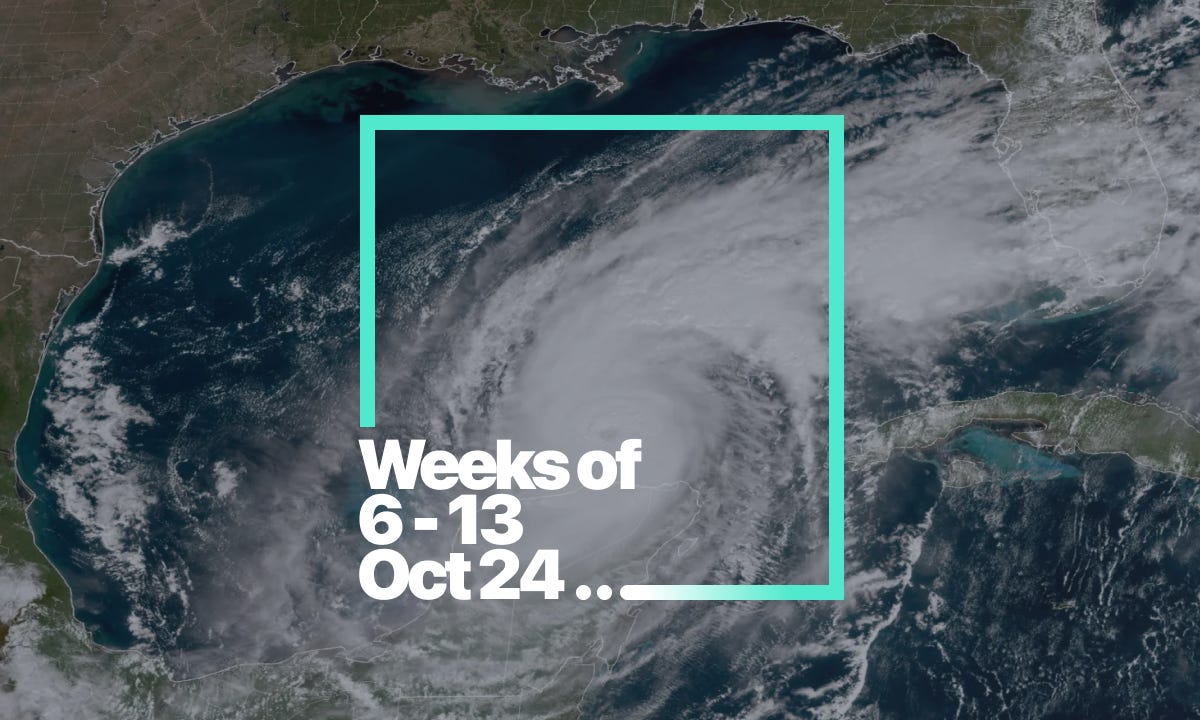

Hurricanes and Elections | Weeks of 6 - 13 Oct '24

Risk concerns this week: US Election too tight to call. Hurricane Milton worst since Katrina. EU tax on China EVs.

Hello 👋 get a brew on because these are the top 3 emerging risks between October 6th, and October 13th, 2024…

Financial | According to fivethirtyeight.com, Trump's Republican party is favoured 544 seats of the House, against Harris' 456 in its data simulation. But the Indepedent says Harris has a +2.6 point lead over Trump (at time of writing).

The unce…